Building Financial Wisdom Together

We believe financial education should be accessible, practical, and grounded in real-world experience. Since 2020, we've helped thousands develop the knowledge and confidence needed to make informed financial decisions.

Our Foundation

Three core principles guide everything we do. These aren't just words on a wall – they shape how we develop content, interact with learners, and measure our success.

Education Over Promises

We focus on teaching solid financial principles rather than promoting get-rich-quick schemes. Our courses cover budgeting fundamentals, investment basics, and risk management – skills that create lasting financial stability. Every lesson includes practical examples from real market scenarios.

Transparency First

No hidden fees, no inflated claims, no pressure tactics. We clearly explain what each program covers, how long it takes, and what you can realistically expect to learn. Our pricing is straightforward, and we regularly share feedback from actual participants.

Long-term Growth

Financial literacy is a journey, not a destination. We design our programs to build on each other, creating a comprehensive understanding over time. Many of our learners start with basic budgeting and progress to advanced investment analysis over several years.

Why We Started tyralonquyvesa

The financial education landscape was filled with expensive seminars promising overnight wealth and complex textbooks that seemed designed for economists. We saw a gap for practical, honest education that meets people where they are.

Our approach combines academic rigor with real-world application. Whether someone is just starting their financial journey or looking to refine advanced strategies, we provide clear, actionable guidance without the hype or impossible promises.

Active Learners

87%Course Completion Rate

18Months Average Engagement

Our Commitment to Excellence

Behind every course, every resource, and every learner interaction is a team dedicated to making financial education genuinely useful. We measure our success by the confidence our learners gain, not by flashy marketing metrics.

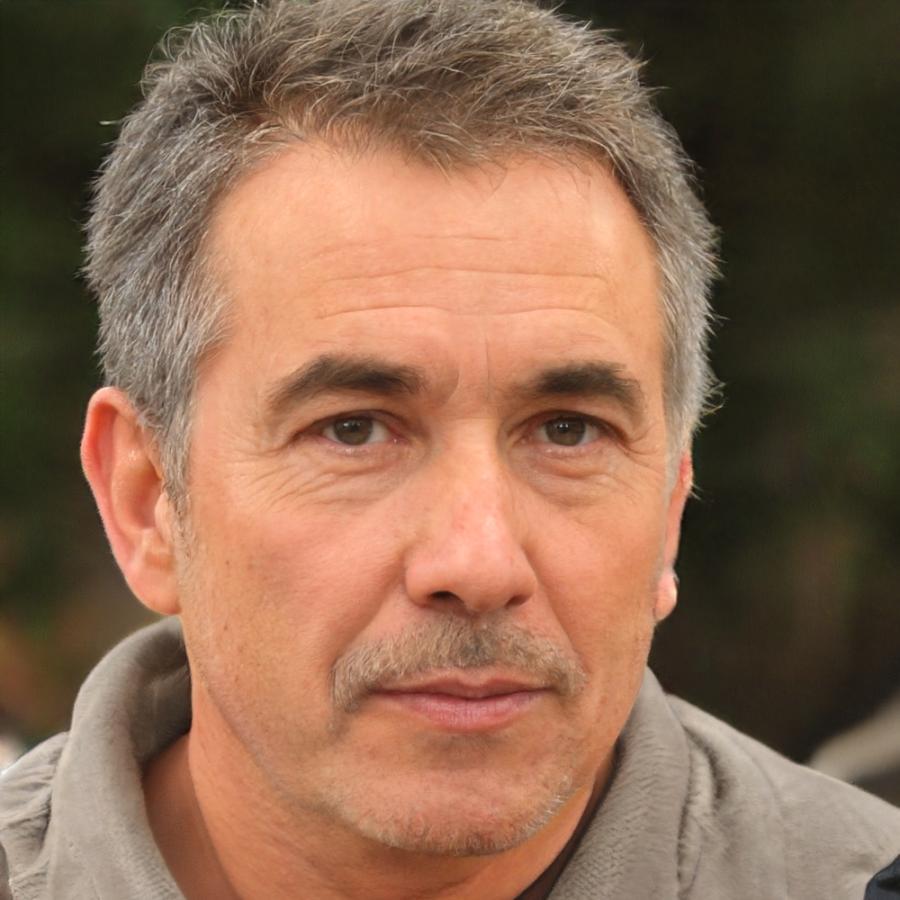

Lysander Thorne

Lead Financial Educator

The best financial education feels like a conversation with a knowledgeable friend, not a lecture from someone trying to sell you something.

With fifteen years in financial planning and education, Lysander believes in meeting learners where they are. His background includes work with both individual clients and corporate training programs, giving him insight into the practical challenges people face when applying financial concepts to their actual lives.

Continuous Learning

We regularly update our content based on market changes, regulatory shifts, and learner feedback to ensure relevance.

Personal Support

Every learner has access to guidance and clarification, because we know financial concepts can be confusing at first.

Practical Focus

Our courses emphasize real-world application with tools, templates, and examples you can use immediately.

Ethical Standards

We never recommend specific investments or guarantee returns – our role is education, not sales.